Jimmy Song is the author of Thank God For Bitcoin and Programming Bitcoin. Subscribe to his Substack Newsletter. And, he was featured on Episode 225 of the Libertarian Christian Podcast, so check him out and this recent piece from Jimmy about Dogecoin!

The market is quite irrational and has been for the past year. Not only are stock prices crazy multiples of profits, or even earnings, we’re seeing behavior from the market that can only be described as completely unhinged. At least with non-profitable companies, there’s some prospect for future growth to make up for the large premium, but with some pumps going on today, there’s not even that.

We’ve seen a lot of stocks pump that have no fundamentals, including companies with little prospects for growth (AMC, GameStop), bankrupt companies (Hertz), and of course, altcoins, much of which hasn’t shown any development at all, let alone usage. This is not a new dynamic per se. Bankrupt stocks have been known to trade at levels that don’t make any sense given that they’re supposed to be worth zero. However, we’re seeing them more frequently and in greater numbers. In this article, I’m going to explain what I think is the cause and how we got here.

Nothing quite captures the current craziness like Dogecoin. It’s in the purest sense, a meme-coin. There’s no purported usage and does nothing technically better than any other coin. It is the epitome of what I call post-modern investing.

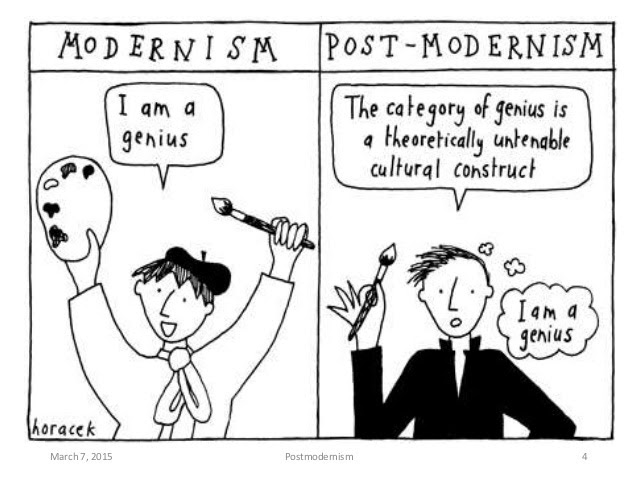

Post-modernism, of course, is the philosophy of complete relativism. There’s certainly some truth to relative value as the stock market is currently a Keynesian beauty contest. As any Austrian economist will tell you, economic value is subjective and can be seen in the daily price fluctuations of nearly every commodity in the market. Post-modernists take it a step further and decide that value is not just subjective but can be controlled by those who have sufficient willpower. Essentially, they believe they can change reality as if it is a democracy, with a majority.

This is the philosophical underpinning of the pumps in stocks and altcoins of questionable value. Post-modern investing denies even the notion of underlying reality. There are only the market actions of buys and sells and enough believers can change price which in turn changes reality, or so the thinking goes. It doesn’t matter if a stock is in bankruptcy, if there are enough believers, they can be raised from the dead because the fundamental reality does not matter.

This attitude is largely fiat’s fault. Specifically, this is due to the cheapness of money. A money that’s valuable, one that helps people to reduce future uncertainty, would not be parted with so easily. Such money would be bound more by the constraints of reality, such as revenue and prospects of growth instead of being a speculative gambling vehicle.

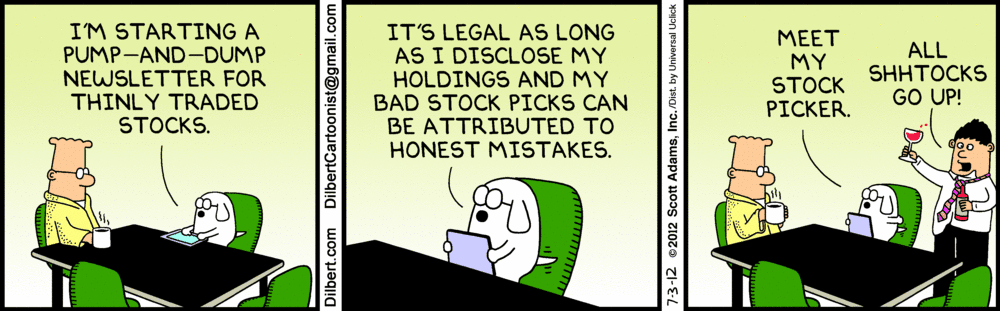

Instead, we have easy money where buying and selling other things is about the only utility. As the money doesn’t hold value, the money’s power is temporary, and it must, in some sense, be put at risk through some form of buying. As these are insider games based on what everyone else is buying, the game becomes more about how many other people are in the investment than about the fundamental potential returns on that investment. In other words, fiat investing is more a trading game and less an investment taking into account profit, revenue, and future cash flows. A market that treats investing as a trading game is one that can be easily manipulated. A market that invests based on profit, revenue, and future cash flows is not. In other words, fiat money makes market manipulation much easier.

As a result, we have pumps of purposefully useless things. In a way, this is refreshingly honest. Instead of the usual lies about what impossible things they are planning to do, there are no promises made at all. The in-crowd is imposing its will on the market. Dogecoin has no long-term value proposition and is not pretending to, yet it pumps simply because enough people want it to pump. It’s an asset detached from reality, or as the post-modern investor sees it, it’s creating its own reality.

This shouldn’t be a surprise as this is the direction that civilization has been moving for many years. Post-moderns deny any sort of reality – biological, economic, and otherwise – and it’s come even for investing.

For those of us that despise the post-modern philosophy, there is good news. These pumps are all short-term and cannot last. At some point, you run out of post-moderns, and investing cartels, such as we have, are by nature not stable. In a sense, the post-modern investors run smack into the reality of game theory and the laws of economics.

The market can stay irrational for long periods of time, but that doesn’t mean fundamental reality doesn’t exist. It just means fiat money has made more post-modern investors.

), //libertarianchristians.com/wp-content/plugins/smartquizbuilder/includes/images/template6-latest.jpeg))

), https://libertarianchristians.com/wp-content/plugins/smartquizbuilder/includes/images/template6-latest.jpeg))

;?>/smartquizbuilder/includes/images/sqb-registration-img.jpg)