This is the ninth article in a series on taxation leading up to Tax Day, April 15.

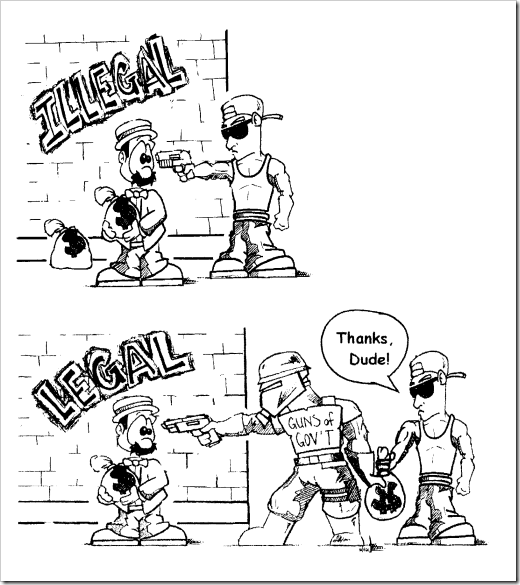

I have already said and illustrated this numerous times in previous articles, but I will say it once again: Taxation is theft, period. To continue this theme, I’d like to show what a few of my favorite laissez-faire economists had to say about the evils of taxation. I have two reasons for doing this. I want readers to understand that it isn’t just me saying these things – there are many people throughout history who understand taxation in this way. Second, these economists explain these ideas much better than I can! Well, at least sometimes they can… :)

1) Jean-Baptiste Say, the formulator of Say’s Law, in A Treatise on Political Economy:

It is a glaring absurdity to pretend, that taxation contributes to national wealth, by engrossing part of the national produce, and enriches the nation by consuming part of its wealth…

Taxation is the transfer of a portion of the national products from the hands of individuals to those of the government, for the purpose of meeting public consumption or expenditure. Whatever be the denomination it bears, whether tax, contribution, duty, excise, custom, aid, subsidy, grant, or free gift, it is virtually a burden imposed upon individuals, either in a separate or corporate character, by the ruling power for the time being, for the purpose of supplying the consumption it may think proper to make at their expense; in short, an impost, in the literal sense.

2) Murray Rothbard, in The Ethics of Liberty (free HTML):

For there is one crucially important power inherent in the nature of the State apparatus. All other persons and groups in society (except for acknowledged and sporadic criminals such as thieves and bank robbers) obtain their income voluntarily: either by selling goods and services to the consuming public, or by voluntary gift (e.g., membership in a club or association, bequest, or inheritance). Only the State obtains its revenue by coercion, by threatening dire penalties should the income not be forthcoming. That coercion is known as “taxation,” although in less regularized epochs it was often known as “tribute.” Taxation is theft, purely and simply even though it is theft on a grand and colossal scale which no acknowledged criminals could hope to match. It is a compulsory seizure of the property of the State’s inhabitants, or subjects.

It would be an instructive exercise for the skeptical reader to try to frame a definition of taxation which does not also include theft. Like the robber, the State demands money at the equivalent of gunpoint; if the taxpayer refuses to pay his assets are seized by force, and if he should resist such depredation, he will be arrested or shot if he should continue to resist. It is true that State apologists maintain that taxation is “really” voluntary; one simple but instructive refutation of this claim is to ponder what would happen if the government were to abolish taxation, and to confine itself to simple requests for voluntary contributions. Does anyone really believe that anything comparable to the current vast revenues of the State would continue to pour into its coffers? It is likely that even those theorists who claim that punishment never deters action would balk at such a claim. The great economist Joseph Schumpeter was correct when he acidly wrote that “the theory which construes taxes on the analogy of club dues or of the purchase of the services of, say, a doctor only proves how far removed this part of the social sciences is from scientific habits of mind.”

3) Hans-Hermann Hoppe, in Economics and Ethics of Private Property (free PDF):

That taxation — foremost and above all — is and must be understood as a means for the destruction of property and wealth-formation follows from a simple logical analysis of the meaning of taxation.

Taxation is a coercive, non-contractual transfer of definite physical assets (nowadays mostly, but not exclusively money), and the value embodied in them, from a person or group of persons who first held these assets and who could have derived an income from further holding them, to another, who now possesses them and now derives an income from so doing…

Thus, by coercively transferring valuable, not yet consumed assets from their producers (in the wider sense of the term including appropriators and contractors) to people who have not produced them, taxation reduces producers’ present income and their presently possible level of consumption. Moreover, it reduces the present incentive for future production of valuable assets and thereby also lowers future income and the future level of available consumption.

Taxation is not just a punishment of consumption without any effect on productive efforts; it is also an assault on production as the only means of providing for and possibly increasing future income and consumption expenditure. By lowering the present value associated with future-directed, value-productive efforts, taxation raises the effective rate of time preference, i.e., the rate of originary interest and, accordingly, leads to a shortening of the period of production and provision and so exerts an inexorable influence of pushing mankind into the direction of an existence of living from hand to mouth. Just increase taxation enough, and you will have mankind reduced to the level of barbaric animal beasts.

4) Frank Chodorov, in Out of Step: The Autobiography of an Individualist:

If we assume that the individual has an indisputable right to life, we must concede that he has a similar right to the enjoyment of the products of his labor. This we call a property right. The absolute right to property follows from the original right to life because one without the other is meaningless; the means to life must be identified with life itself. If the State has a prior right to the products of one’s labor, his right to existence is qualified. Aside from the fact that no such prior right can be established, except by declaring the State the author of all rights, our inclination (as shown in the effort to avoid paying taxes) is to reject this concept of priority. Our instinct is against it. We object to the taking of our property by organized society just as we do when a single unit of society commits the act. In the latter case we unhesitatingly call the act robbery, a malum in se. It is not the law which in the first instance defines robbery, it is an ethical principle, and this the law may violate but not supersede. If by the necessity of living we acquiesce to the force of law, if by long custom we lose sight of the immorality, has the principle been obliterated? Robbery is robbery, and no amount of words can make it anything else.

LCI posts articles representing a broad range of views from authors who identify as both Christian and libertarian. Of course, not everyone will agree with every article, and not every article represents an official position from LCI. Please direct any inquiries regarding the specifics of the article to the author.

Did you read this in a non-English version? We would be grateful for your feedback on our auto-translation software.

), //libertarianchristians.com/wp-content/plugins/smartquizbuilder/includes/images/template6-latest.jpeg))

), https://libertarianchristians.com/wp-content/plugins/smartquizbuilder/includes/images/template6-latest.jpeg))

), https://libertarianchristians.com/wp-content/plugins/smartquizbuilder/includes/images/template6-latest.jpeg))

), https://libertarianchristians.com/wp-content/plugins/smartquizbuilder/includes/images/template6-latest.jpeg))

), https://libertarianchristians.com/wp-content/plugins/smartquizbuilder/includes/images/template6-latest.jpeg))

*by signing up, you also agree to get weekly updates to our newsletter

Sign up and receive updates any day we publish a new article or podcast episode!