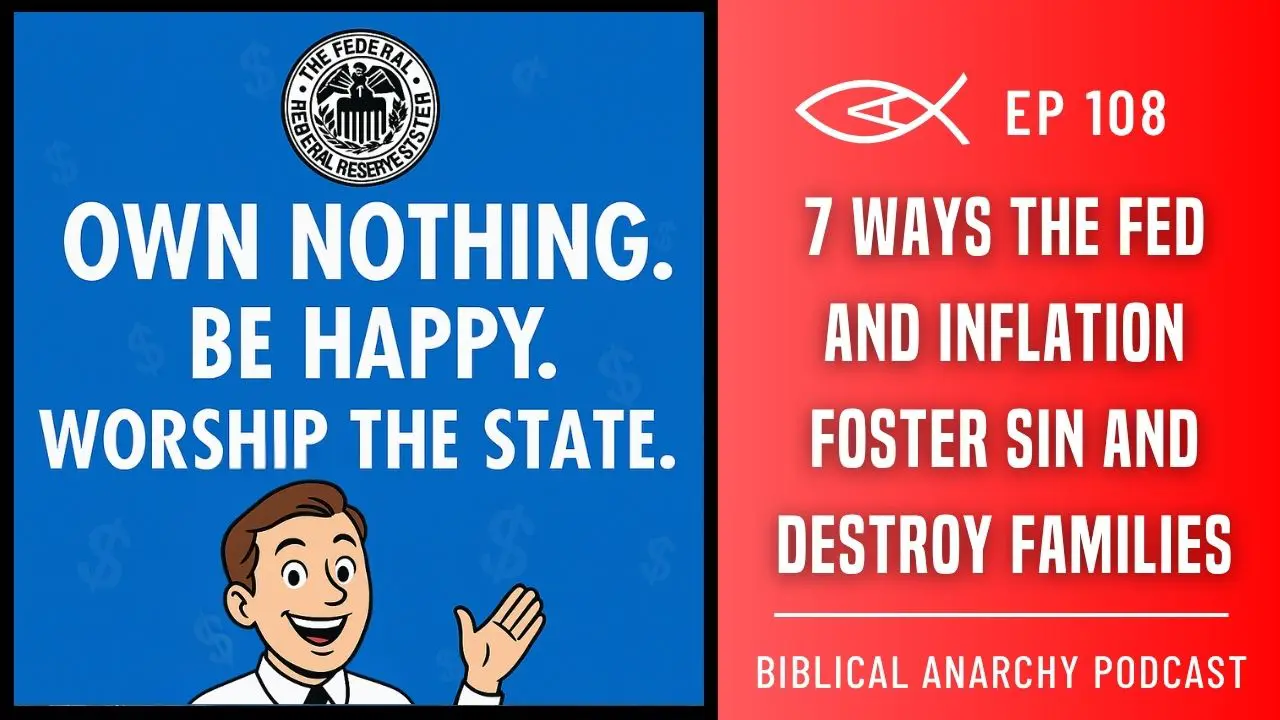

The Federal Reserve isn’t just an economic institution—it’s a moral crisis hiding in plain sight. In this episode, Jacob Winograd sits down with economist Dr. Jeffrey Degner to reveal how the Federal Reserve’s manipulation of money quietly undermines Christian virtue, fosters sin, and weakens the family. Drawing from Scripture and Austrian economics, they unpack how dishonest monetary policy violates biblical principles, erodes personal responsibility, and replaces stewardship with state control.

Christians often see inflation as a technical or political issue, but the Federal Reserve’s entire system of central banking is built on deception—unequal weights and measures that God explicitly condemns. Jacob and Dr. Degner expose the spiritual and social fallout of this corruption, showing how it reshapes the modern family, distorts our moral compass, and traps entire generations in dependency.

Together, they identify seven ways the Federal Reserve fosters sin and destroys the family:

Through biblical exposition and moral clarity, Jacob Winograd and Dr. Jeffrey Degner challenge listeners to see the Federal Reserve not merely as an economic system but as a moral engine that distorts the image of God in man. Christians are called to expose dishonest scales, defend the family, and rebuild a society rooted in truth, stewardship, and voluntary exchange.

| Time | Summary |

|---|---|

| 00:00 | Jacob introduces inflation as a moral and spiritual issue that erodes the Christian family. |

| 01:00 | He welcomes Dr. Jeffrey Degner and outlines how the Federal Reserve distorts God’s design for stewardship. |

| 02:15 | Degner shares his background, testimony, and path to studying Austrian economics. |

| 08:05 | He explains his PhD on “the family in the inflation culture” and how the idea developed. |

| 13:40 | They discuss how the Federal Reserve violates biblical justice through dishonest money. |

| 19:30 | Conversation turns to inflation’s impact on property rights and human dominion under God. |

| 26:10 | Degner describes how inflation discourages marriage, home ownership, and family stability. |

| 33:20 | They explore how rising costs force dual-income households and erode family discipleship. |

| 40:15 | Discussion shifts to moral hazard—how easy money encourages greed and debt dependence. |

| 47:00 | Jacob and Degner connect high time preference to cultural decay and loss of self-control. |

| 54:15 | They examine how inflation weakens generosity and distorts the Church’s mission. |

| 01:02:00 | The episode closes with reflections on moral renewal, honest money, and Christian resistance to the Federal Reserve’s system. |

Will Ending the Federal Reserve Strengthen or Weaken America? — A conversation with Bob Murphy about the Federal Reserve, fiat money, and viable alternatives to central banking.

http://libertarianchristians.com/episode/will-ending-the-federal-reserve-strengthen-or-weaken-america-bob-murphy-weighs-in/

Ep. 215: The Federal Reserve with Bob Murphy — A detailed exploration of how the Fed operates, its moral implications, and why it continues to distort the economy.

https://libertarianchristians.com/episode/ep-215-the-federal-reserve-with-bob-murphy/

Jacob Winograd [00:00:01]:

Inflation isn’t just about prices at the grocery store. It’s about broken homes, delayed marriages, fewer children, and a culture where family life itself starts to feel like a luxury. Today, we’re going to be talking about how the Federal Reserve and central banking are quietly reshaping the Christian family.

Biblical Anarchy Podcast Announcer [00:00:23]:

If Christ is king, how should the Christian consider the kingdoms of this world? What does the Bible teach us about human authority and what it means to love our neighbors and our enemies? Before we render unto Caesar what is Caesar’s, let’s know what it means to render unto God what is God’s. This is the Biblical Anarchy Podcast, the modern prophetic voice against war and empire.

Jacob Winograd [00:00:54]:

Welcome back to the Biblical Anarchy Podcast. I’m your host, Jacob Winograd. In today’s episode, I had the privilege of sitting down with Dr. Jeffrey Degner, assistant professor of Economics at Cornerstone University and a fellow at the Mises Institute. He is the author of Inflation in the Family, a book that digs into how central banking and fiat currency don’t just distort markets, they undermine the very institutions God designed for human flourishing. We got into everything from how inflation delays marriage, discourages children, to the way moral hazard seeps into family life, to why Christians should see unequal weights in measures and monetary policy as a matter of biblical justice. So this conversation connects Austrian economics with biblical truth and shows why Christians can’t afford to stay silent on central banking. So with that, I’ll go ahead and switch over to that interview.

Jacob Winograd [00:01:54]:

Hello, everyone. I’m Jacob Winograd, and I’m excited to be here with our guest, Jeffrey D. Degner. Jeffrey is a assistant professor of economics at Cornerstone University and a fellow at the Mises Institute, has a PhD in economic science from the University of Engers Angers. I made that mistake once.

Jeffrey D. Degner [00:02:13]:

I went to France for the first time. I got a swift correction on the right pronunciation.

Jacob Winograd [00:02:18]:

Good. Good. And you have a dissertation on the family in the inflation culture, and that’s what we are here to talk about tonight. So, Jeffrey, thanks for being here and could you just go ahead and, you know, I gave you a little bit of an introduction, but go ahead and share anything about, you know, your background as a Christian, as a fellow, you know, Austro libertarian, and then we’ll kind of get into tonight’s conversation.

Jeffrey D. Degner [00:02:42]:

Well, thanks for having me, Jacob. It’s a real privilege to be with you. And yes, I’ve been at Cornerstone University here in Grand Rapids, Michigan, going on eight years now, and I’ve stepped into a little bit of an administrative role and so I’m the dean of the School of Business and gives me a real wonderful opportunity to engage in hiring, curriculum development and things like that. And at a Christian university like Cornerstone, we’re deeply committed to properly integrating the Christian worldview. And a lot of places say that, but I think that we’re doing a real good job of it here at Cornerstone. And so my personal background and walk with Jesus started really as a young child and grew up in a Christian home where we were really in the sort of fundamentalist Baptist tradition, very much sort of an Armenian approach. And so, you know, regular altar calls and struggles with assurance of salvation in my early years were a real, real challenge. But at a point we moved to a church in southwest Michigan and I was beginning to engage with Bible study in my junior high years.

Jeffrey D. Degner [00:03:48]:

We had a wonderful youth pastor and engaged me and my siblings in the discipleship process. But then, and I think your readers, your listeners will take the hint here, we had a pastor give a five part sermon on Reformed theology that has somewhat of a floral theme, if you follow my meaning. And there was essentially church split over this. But my, my parents, thankfully, from my perspective, leaned into the teaching and really that was a jump start for me into the Reformed tradition. And some of those early struggles with assurance of salvation and so forth were mercifully taken from the Lord and taken away by the Lord. And really it’s just been a process of continuing to grow in the Lord over the years. And I’ve had the opportunity to serve as an elder at that church. But now we’ve moved to Grand Rapids.

Jeffrey D. Degner [00:04:45]:

And one of my passions prior to getting the Cornerstone was, was still in the teaching realm. So I had taught in the ninth through 12 grades for about 13 years, but during that time in a public school setting, was still engaging with theological studies and leadership at church. And so there were many times even in a public school classroom where I was able to share testimony of the Lord’s work. And students were drawn to that in many cases. And so that’s a little bit of my work background. But to be a little more specific, on the economic side of things, I received a Bachelor’s of Economics from Western Michigan University. And it was very much a Keynesian approach. And I was busy with life.

Jeffrey D. Degner [00:05:34]:

I will admit to you and I admit to my students here at Cornerstone, I was not the model student. In fact, I met my wife and got married and had a mortgage before I finished school. And so my studies were, I don’t want to say a side quest, but it just wasn’t my main focus. So I was doing the work to get through. But then in 2010, I received an invitation to go to a teachers conference at Hillsdale College. And that was even though I’d studied economics and begun my Master’s in economics. That was the first time that I ever heard the name Hayek or Mises or even Milton Friedman. And at that point I began really a self study, a self education in the Austrian School that’s continued up until this very day.

Jeffrey D. Degner [00:06:27]:

And I’ve had the privilege to be engaged with the Mises Institute, really since that time. And now I’m a fellow there. And so that’s a little bit of how we got here. But my PhD process was also a real blessing that came through that association with the Mises Institute, because when I arrived at Cornerstone, I had a Master’s in economics. But part of the sort of condition of my employment was that I would pursue a PhD, and there were not any programs in the US that allowed me to work full time and earn a PhD, say, online in economics. And so I reached out to the then president of the institute, Jeff Diest, and he recommended that I reach out to Guido Holzman at the University of Angers in France, and said that my circumstances kind of sounded like a fit for studying with Professor Holzman. And so that was in 2019, about a four year process to finish the PhD in the family in the inflation culture. And I’m sure we’ll have a chance to talk about what we mean by the inflation culture, but that’s how this book came about.

Jeffrey D. Degner [00:07:38]:

So the book is really a spin off and a revision of the dissertation. We took out some of the technical things and more of the mathematic stuff and made it still an academic book, but a little more accessible. And so my goal in the next year or so is to have something published on this theme that is really meant for the educated lay audience. And so that’s a long way of describing how we were able to connect. But in any case, that’s a little bit my background.

Jacob Winograd [00:08:08]:

Awesome. And yeah, of course I’m a huge fan of the Mises Institute. They helped me out when I, you know, first started sort of doubting my traditional, you know, kind of Keynesian upbringing, and I was more of a democratic socialist. And then after Trump was elected and the left sort of went their way and I kind of was politically homeless. I discovered libertarians and discovered the Mises Institute and actually had the privilege of meeting Jeff Dice once. Really, really great guy, really eloquent eloquent speaker and they’ve done a lot of good work to increase economic literacy. Now, I hope most of my audience knows a lot of what we’re talking about in terms of at least just the context of what we mean by, you know, Austrian economics and, you know, sort of the skepticism of government intervention and the, the role the Federal Reserve plays and like the boom, bust cycle. And I’ve done episodes on this in the past.

Jacob Winograd [00:09:05]:

I’ve had Bob Murphy on the show and we’ve talked about this. So, you know, I would encourage people listening to this that we don’t have too much time to necessarily do a sort of like, you know, Austrian Econ 101 here. So you might want to go and check out those resources before you listen to this conversation or after you listen to this conversation, if you want to know more about the, the Austrian school. But it is sort of what I just said, a skepticism of central banking, of the idea of fiat currency and money printing and just sort of the distortions to prices and signals in the market and sort of bubbles that occur from that, as well as the role that that plays on inflation, which is sort of, you know, I think the focus of what we’re going to be, one of the focuses of what we’re going to be talking about in this conversation. Is there anything you want to, you know, before we dive into the, the meat and potatoes here that you’d want to add to what I said, just in terms of a setup of, you know, just the Austrian school of economics, you know, anything you want people to be thinking about if they’re, you know, maybe kind of familiar or not very familiar with, with sort of this subject.

Jeffrey D. Degner [00:10:12]:

One of the things I like to remind my students or other people who are new to the Austrian school is the central emphasis on the role of subjective valuation. One of our really strong Austrian economists, Per Bielen, does a nice job of describing how we have values as a noun and then we have valuing or valuation as a verb. And so when Austrians talk about subjective valuation, we’re not saying that we don’t have an anchor for morality. What we’re saying is that, you know, if I think about how I value, this is what I use with my students, as you might imagine at a college, how I value pizza, right? To me, pineapple on pizza is an abomination. That’s an economic bad in my world. But, you know, other sort of meaty toppings, right? That would be a higher value. I would prefer that over that culinary abomination, right?

Jacob Winograd [00:11:14]:

Right.

Jeffrey D. Degner [00:11:14]:

And so this is what we mean by subjective valuation. We place values on what we deem to be economic goods and then we rank them in an ordinal fashion. We prefer one thing over the other. And I think that that really is copacetic with the scriptures. I’m sure your readers will remember what Jesus said about what we should prefer first in our life. Matthew 6:33. Seek first the kingdom of God and his righteousness and all these other things will be added to you. It’s, it’s ordinal language about what we prefer the most and then other preferences or things that we desire come in subjection to that.

Jeffrey D. Degner [00:11:54]:

The Austrians just acknowledge that that is how the human mind works when we value different things in that sense of value as a verb or valuation as a verb. So I think that’s really, really key to understanding the Austrian approach. There are a few other more technical matters, but I always like to start there.

Jacob Winograd [00:12:11]:

Yeah, absolutely. Subjective value, marginal utility, these are all very important concepts to the, the sort of like Austrian view of economics and the idea of human action and the see to use your analogy there, I would pay premium for a pineapple pizza, whereas you would not even pull your wallet out if someone put that in front of you. So that subjective value in action. So the, let’s dive into then you know, some sort of like big picture theological foundations of, of sort of like what the Bible says about economics. And you know, the Bible warns against unequal weights and measures. And so would you see, and if you do, how would you explain the idea that central banking and you know, fiat money and currency are sort of like, you know, modern day examples of that sort of economic injustice?

Jeffrey D. Degner [00:13:08]:

Well, that’s, that’s a great question. And one of the things to remember historically you look in the scriptures or at history in general, is that money in the past, and by the past, I mean past centuries, has been regarded by its weight. This is a critical point that when my grandparents would talk about a 1 oz gold piece that was a direct reference to the money, we understood value based on weight. Well over time in the 20th century, with the establishment of the Federal Reserve, there began to be a detachment of the value of money related to a weight of gold or silver. So in the scriptures, this is why we can look and see where wherever we have unequal weights and measures, God calls it an abomination. It is a deliberate act of deception that even the pagans understand. This is a point that I really emphasize to our students here at Cornerstone. If we look at the figure the sculptures we have throughout the Western world of what we call Lady Justice.

Jacob Winograd [00:14:21]:

Right.

Jeffrey D. Degner [00:14:21]:

Well, lady justice is actually, I believe the Greek goddess had the name Dike. So this is a false goddess. But even the pagans understood that there needs to be balanced scales. I mean, this is in a sense, where we have a general revelation to those who believe in the true God and even those who don’t, where everyone understands that that to alter weights and measures in the marketplace is essentially a criminal act. And so we see that the importance of equal weights and measures, both in general revelation, but even specifically in the scriptures that you refer to Proverbs over and over, talks about the importance of equal weights and measures. And then we could maybe talk about this. We see the consequences of. Of diluted metals for money in passages like Isaiah chapter one and again in Ezekiel 45.

Jeffrey D. Degner [00:15:23]:

So that might be something that we want to touch on here. But the importance of the connection between money and certain weights of precious metals is really critical to understanding the injustices that we experience under a fiat paper or really a digital. That the ultimate horror show would be the central bank digital currency.

Jacob Winograd [00:15:45]:

Right.

Jeffrey D. Degner [00:15:46]:

Again, that’s another topic we could touch on. But those are a couple of reminders that I really like to relay to people.

Jacob Winograd [00:15:52]:

Yeah. And there are. There are so many distortions that we’ve kind of been, you know, kind of hinting at that are caused by this system. But even just on its basis, I think just kind of like understanding that when it’s backed by fiat. Right. It’s not backed by an objective. You know, you can exchange this dollar bill for this much in silver or gold. You’re already not dealing with something that is, you know, solid.

Jacob Winograd [00:16:19]:

Right. And we want, you could say, we Austrians, we. We see value as subjective, but we want our currency to be, you know, very hard and objective in a sense. Right. We don’t want to.

Jeffrey D. Degner [00:16:29]:

I like the word anchored.

Jacob Winograd [00:16:30]:

Anchored, yes. That’s a good way to put it. So, you know, why should the Christian be concerned about this beyond just like, you know, I brought up a, you know, a certain saying that’s from Scripture, but just kind of more to hone in here because some Christians might say, well, this is, you know, economics, this is politics. You know, maybe it’s bad policy, maybe it’s not good. But, like, you know, is. Is money or economics? Are these just sort of like, you know, neutral playing fields? Or do, you know, Christian values really come to bear in terms of how we view money and economics? And like, is it an inflation, you know, when we’re thinking about that. Is that just bad for economies or is that something that’s even bad on a level of morality or even in terms of, you know, viewing things through the lens of spiritual warfare, as the Bible instructs us to do?

Jeffrey D. Degner [00:17:25]:

Yeah, yeah. Well, there’s a few things there. And I guess where I would start is to think about this notion. And economists, especially in the Austrian school, have done our very best to do economic science in a way that is, I’ll use air quotes here, value free. Ludwig von Mises makes a very strong point of this in Human Action, his magnum opus, and also in other places. But even Mises admits that there may be, as best as we try, a value judgment that we’re going to make in the process of doing economics. And so one of my friends and colleagues, by the name of Carl Friedrich Israel, he teaches in France, and he presented a paper last year at the Austrian Economics Research Conference where he put forward the idea that to do economics properly, we actually really do need to make way one key value judgment, and that is a judgment around the role of property rights. And essentially, if you’re going to do economics, if you’re going to study voluntary trade, you must have property rights at its basis, really, an unashamed stand on absolute property rights.

Jeffrey D. Degner [00:18:48]:

All right, now, I tend to agree with that. And it’s not just because I think that that’s a wise way to come up with outcomes and trade that increases wealth. That’s a consequentialist argument. And it is true that property rights are necessary for trade, for understanding profit and loss and having a rational economy. But as a Christian, I am, I am deeply concerned about property rights for the reason that Genesis 1:27 and 28, I believe, lays out the importance of property rights to humankind itself. Now, normally folks will think of Genesis 1:27 and 28 as a cultural mandate, right? A mandate, a command to be fruitful, to multiply, to spread throughout the earth, to subdue all things and to have dominion. But this last year, just in my own personal study and wanting to enhance what we’re doing in the classroom here at Cornerstone, I took a deeper dive there. And actually just the tools that are available to us through some of the Hebrew study tools, was able to look at that.

Jeffrey D. Degner [00:19:58]:

And it’s actually, it’s a beautiful passage in so many ways, but it’s not. First a command. Genesis 1:27 gives a word picture of God stooping down to Adam and Eve as a father would stoop down to bless his children. And he Blesses them, The language says blesses them to be. It’s not a to do, it’s a to be the creature, the unique creature who adds the unique creature in creation who multiplies, who spreads throughout the earth, and to be the only creature who is unsubdued or unruled. Okay, that would be the opposite of being the one creature in creation that subdues all the others and that rules all the others. Well, those last two features to subdue and rule I think speaks crystal clear that human beings are, are property owning creatures and we are unique in this sense. And so I think that’s a pretty good basis for studying economics and trade and voluntary exchange.

Jeffrey D. Degner [00:21:12]:

But the other part that’s very important is that it gives us a biblical rationale for why forceful coercive intervention to extract someone else’s property or to prevent another human from adding to their wealth, to prevent another human from multiplying their productivity is immoral at its core because it’s attacking. It’s a dehumanizing act. It’s not that we should avoid these things just because they lead to bad economic outcomes, which we can demonstrate that. But most importantly, it’s a violation of the human person who are made in God’s image. So that’s where I’ve come to in the past year. And I think that’s a more compelling case for Christians that interventionism, that this is a violation of the human person.

Jacob Winograd [00:22:03]:

Yeah, that’s. That’s a really compelling answer. You know, I think this is a little off topic, off script, but you know, one of the things that the state does, which is not unrelated to what we’re talking about completely, but that is sort of just more foundational is that like, it forestalls the ability of individuals to just go and homestead property, you know, sometime or even just to like have control over property which they already own and to homestead it further. Right. And you know, these might seem like small things, but they’re actually. I don’t know how to like make a value judgment of saying like, well, it is. It’s sort of like by what authority does the state say that? Like, you know, like no one is living on this land or. And so I can’t go and build a house there and do anything with it or on my own land, you know, like to.

Jacob Winograd [00:22:57]:

As long as I’m not hurting anybody else, you know, that kind of control. People just sort of like accept it as like a sort of like. Well, of course, like, you know, all the land is either owned by the state or the state can then sell it to, you know, banks and private firms. And you see a lot of people on the right and the left complaining about, like, all these, you know, sort of like private equity firms. A lot of them are, like, owned by, you know, international corporations or foreign interests. And they’re like, buying up all this land and this property. And they’re like. And they’ll be like, well, that’s, you know, the problem with capitalism.

Jacob Winograd [00:23:34]:

I’m like, that is not capitalism in the slightest. You know, not, not in the Austrian sense of the, you know, how we would ground private property and homesteading so well.

Jeffrey D. Degner [00:23:46]:

This is an interesting point of debate among conservatives, libertarians and Austrians is whether or not it’s a sort of legitimate purpose or a legitimate practice for, let’s say, certain groups to purchase property. And that’s an ongoing debate whether such groups or corporations, you might say, ought to be allowed to purchase property here or there. And so, yeah, that’s a lively, ongoing discussion. And yeah, one that does again, strike at the root of this question on property rights. And when a human is prohibited from disposing of their property as they would see fit because of some other ruler right, to go back to that Genesis 1:27 language, what you have there is another human asserting their rule over another person. Well, reflecting back, it is people who are given rule or dominion over animals, right? The birds of the air, the fish of the sea, the creeping animals on the earth. And so to exert that kind of dominion or control or preventing other people from using their property as they see fit is essentially to treat another human in almost an animalistic sort of sort of way.

Jacob Winograd [00:25:10]:

Yeah, no, it’s a very seriously. Yeah, not a very good point to dive more into your, your book and your writing on, on inflation and the family. So you, you’ve said that marriage today, not just you, you also, you cite many other people who have done their own, you know, studies and analysis of, of marriage over time historically and, and then in America in the, you know, 19th, 20th and 21st centuries. But that, like today, marriage looks more like a luxury item than sort of like a foundational aspect of life or like a foundational building block of society. And so how, how would you explain how central banking has contributed to that shift?

Jeffrey D. Degner [00:26:00]:

So I’ll first really start with the claim that marriage has become a luxury good over time. And the way, or the reason that I put it that way is because we should be taking a look at who is getting married nowadays. Well, it tends to be young and not so young anymore. Right. But people who are going into their late 20s, even mid-30s on average, who typically have a couple who’s got a man and a woman, who are both college graduates and both have relatively high earning potential. And what’s happened is that among the middle class and the lower classes, that marriage has essentially been liquidated. Now, this is not my opinion. This is through a lot of studies that have been done by economists on both the left and the right, and they’re recognizing that marriage is vanishing as an institution among the middle and especially the lower classes.

Jeffrey D. Degner [00:27:03]:

Well, how or why has this happened over time? This didn’t just happen all of a sudden, say, in the 1960s with the sexual revolution. There was more to it, more of a slow burn to this sort of situation. And so what I argue is that when we start with the Federal Reserve, our central banking system, as it was launched in 1913 and beyond, we start to see an ongoing steady inflation year after year after year, and inflation rates rarely, if ever decrease. So this is a compounding loss of purchasing power over several generations. So what this has done is created a situation where today younger people are coming into their 20s with less purchasing power than their parents or their grandparents. Now, this is delaying situations or delaying the opportunity for, let’s say, home ownership, which is over time, it’s really been shown as a critical sort of life step to move into marriage. And of course, some people will get married first, rent for a while, and then moving and purchasing. But we do have historic precedent for some folks who go and purchase a home first.

Jeffrey D. Degner [00:28:25]:

And as, let’s say, a young man, you. You show yourself as a stable provider, and this is attractive to. To a potential spouse. And. And you go that way. But that lost purchasing power and the increased difficulty of making ends meet among the middle and lower classes has made marriage less. Excuse me, more difficult to obtain to. Right, and so that’s what I mean by the liquidation of marriage among the middle and lower classes.

Jeffrey D. Degner [00:28:56]:

And that who’s able to afford it essentially has been relegated to people in the higher echelons of income and earning power over time.

Jacob Winograd [00:29:06]:

Yeah, and that’s definitely something that, you know, I kind of went a very weird direction for my generation because everyone in my age group, as I graduated in 2011, and everyone’s going off to college, everyone’s, you know, making plans for what they’re going to do, and many of them, you know, not getting married until, you know, probably they’re in their late 20s or often, like even now, like, I’m. I’m 33, and I know many people I went to school with have only now, you know, gotten married in the last, you know, couple years or so and started having kids. Whereas I went more the route you went where you described, where it’s like I just started working right away and was just not even renting, just living with my. With my dad. At first. My, My. My. My wife and I, we got married young and started having kids young.

Jacob Winograd [00:29:59]:

And that is not the norm because of kind of what you’re getting. Like. Like, marriage is seen as like. Like, you can’t just get married. You have to. There are, like, these economic sort of. You can almost say, like, it’s sort of like.

Jeffrey D. Degner [00:30:13]:

Like milestones.

Jacob Winograd [00:30:14]:

Yeah, milestones. Or like these. Like, it reminds me of that. What’s Haslow’s high hierarchy thing of. Needs.

Jeffrey D. Degner [00:30:21]:

Yeah.

Jacob Winograd [00:30:21]:

Needs. Yeah. They’re almost like, like, well, marriage is like, you know, really not like one of those, like, foundational needs. That’s like, if I kind of build up my life in a way where then it makes sense to get married, then I’ll do that, but it’s not a priority. Whereas, you know, there are many things that my Christian upbringing was lacking in, but the importance of marriage was not lost on me actually being the product of a divorced household and my. My at the time, fiance being a product of the. Of divorced household. We were like, you know, we saw what broken marriages and lack of marriage looked like, and we were like, we.

Jacob Winograd [00:30:59]:

This is super important, and we want to get it right. So I, I kind of. Listen, I think the economic stuff makes sense and matters, but I mean, my encouragement to people is that, you know, there are. There is value to marriage beyond just the. The sort of, like, rite of passage that, like, ooh, I’ve. I’ve finally gotten there. It’s a beautiful thing to like, actually get, like, if God has that in plan for you to get married young and then you get to grow with your spouse as you build your family and you. You go through those milestones of life together.

Jacob Winograd [00:31:38]:

But, yeah, certainly there are. Even the route we’ve taken, there are difficulties because of, you know, just economic realities that are, you know, put in front of us. So, like, what are some of the ways inflation has made it harder for young people to not just get married, but just to have kids and to just sort of build stable homes and build wealth.

Jeffrey D. Degner [00:32:01]:

Yeah. I think when we. Boy, there’s a few ways to go with this, but I want to think about, let’s say, a young couple. Let’s Say they, let’s say they take that route, they get married a little bit earlier than the average. Right now in the United States, the average age at first marriage for men I believe is about 29.2, women a little bit younger. And that’s standard across nations, about a three year gap or so. In, in Japan, average age at first marriage is over 30 years old for men and similarly for, for young women. And so let’s say though that you do start out at that, let’s say 25 and 22, let’s go with that.

Jeffrey D. Degner [00:32:45]:

In all likelihood, you’re probably going to be renting and getting yourself started, getting your financial wheels turning, save some money as best you can. But as we look at inflation rates in the housing market, and I’m talking, you know, single family homes, right, this is becoming more and more difficult for young people and young couples to obtain to. So you wind up in the rental situation for longer than you otherwise would. And a lot of this is driven by inflationary practices by our central bank. Well, what’s the consequence then for say, having children? Well, of course, if you’re renting in an apartment situation, you can’t blow out the walls and add a nursery, right? You’re running out of elbow room. And the empirical data from a number of countries, I note this in the book, but it backs this up, is a very interesting finding that came out of Wales and Great Britain more broadly, is that if you are married and you’ve got children and you’re a home owner, when there’s inflation in the housing market, you’re already an owner, your net worth is going up, you have what economists call a wealth effect, you feel wealthier. So indeed, you can take some of that equity and maybe blow out for a new nursery or get into a larger home. But on the flip side, if you are in a rental situation, then this stifles fertility and there’s actually a negative relationship where prices in the housing market increase, you’ll see declining fertility among those folks who are renting.

Jeffrey D. Degner [00:34:24]:

And so there’s, there’s different outcomes, right. When there’s inflation, some folks will benefit by it and other people will be harmed by it, by it. And that’s a real concrete case, I think, of fertility questions around inflation in the housing market specifically. But we see that pattern emerging throughout the Western world. That’s not just an American or British phenomenon, it’s throughout the Western world.

Jacob Winograd [00:34:51]:

As you may know, the team at Podsworth Media has worked with me for a long time producing this show and most of the shows at the Christians for Liberty Network. A big part of that over the past couple years has been using the Podsworth app to make the audio sound clean, level and professional, even when the raw recordings were super sketchy like this one you’re listening to right now. Believe it or not, this recording was that bad before I ran it through the podgeworth app and you can hear the full before and after demo for yourself at the link in the description. The app has recently got a huge update and and it’s better than ever. So good, in fact, that it can take almost any atrocious voice recording and make it sound great. Here’s how it works. It removes background noise. It cuts down on plosives when I don’t use my pop filter.

Jacob Winograd [00:35:42]:

It fixes clipping when your gain is too high or when you’re like me and you get really animated and you start to yell really loud. It removes clicks and pops. It reduces reverb. It improves tone and levels out the dialogue so you don’t get crazy volume jumps and everything is consistent. Using it is super simple. Just go to podsworth.com and click. Get started. You don’t need a subscription or to sign up.

Jacob Winograd [00:36:08]:

Drag and drop your audio files or open them right from your smartphone’s browser. Customize your settings if you want to, but honestly, the default works great for most recordings. Enter the code LCI50 to get 50% off your first order. No account needed, just your email and payment. You’ll get a download link in your inbox with your cleaned up files. It’s Perfect for podcasts, YouTube videos, sermons, audiobooks, you name it. If your recording sounds rough, the Podsworth app can make it not only listenable, but professional. Remember, when you use the code LCI50, you’ll get half off your first order and you’ll also be supporting this show and the rest of the Christians for Liberty Network.

Jacob Winograd [00:36:54]:

One of the things which I’d be curious to get, you know, you to add on to this that I’ve, I’ve talked about not just in my podcast, but just like when I’m talking to people at my church about things like so we’re a homeschooling family and so now we have two that have started homeschooling. One that’s kind of like, you know, we’ve started to get him ready for it. He’s like preschool age. He’ll probably do kindergarten next year so. Or first grade next year. But a lot of people say like, well like how do you do it? Because like you got to have one parent stay home, to be able to homeschool everyone. You know, most, you know, evangelical Christians, and you especially reformed Christians, you know, we, we detest the public school system, but unless you can. So, I mean, you can either, hopefully you can afford to send your kids to private school.

Jacob Winograd [00:37:41]:

Not all private schools or Christian private schools are necessarily better than the public schools though. And homeschooling, even if it seems like something you’d want to tackle, can you afford it? And as that, you know, everything raises in cost and your dollar goes less far and less far. This is, you know, a hurdle to not just like getting a family, but then like how you are going to build and lead your family because the choices that you might otherwise make come up against economic realities. And I mean, it’s, you know, I, I can speak from personal experience that it’s, you know, I work very hard to try to make it work. But you know, it’s oftentimes been by the Lord’s provision that we, we’ve been able to stay afloat through, especially, I mean, the, the, the COVID insanity only, you know, took that and dialed it up to 11. So what, what are your thoughts on that? Just in terms of anything you’d want to add in terms of, you know, helping? You know, I think our libertarian audience is going to resonate with this a lot. But for our Christian audience, I think this is just another example of, you know, the ways in which inflation are going to restrict what we as Christians are going to do, be able to do when it comes to the rearing of our children and, you know, sort of like building up of our, our families and our communities.

Jeffrey D. Degner [00:39:12]:

Well, that’s such an important question and I have a deep appreciation for it. And I, I hope when I say this that doesn’t come across the wrong way. But when we talk about spending time with our children, whether it’s in an educational sort of function or, you know, taking them to the park or just for, for health reasons, economists regard this as leisure time. Okay. In other words, any time that is not spent in the labor market earning income, that’s, that’s leisure broad.

Jacob Winograd [00:39:43]:

It’s an economic term, not a right. You’re not saying like, you know, how dare you.

Jeffrey D. Degner [00:39:49]:

Right, exactly, exactly. So what happens in an inflationary world and in order to make ends meet, to buy groceries and to pay for the ever escalating gas bill and electric bill and so forth, this requires income. All right? And the more time that we wind up spending in the labor markets, that’s time away. From the household, plain and simple, the percentage of dual income households, as we know over time, a slow and steady rise that really tracks with inflationary pressure. So you’re right, Jacob. I pray for you in this, brother, because they’re tough decisions to be made. Does dad go and work 60, 65, 70 hours a week? I mean, at a point we start asking the question, okay, well, is mom able to go into the labor market and do some things or maybe some Internet based. Right.

Jeffrey D. Degner [00:40:44]:

More time spent in the labor market. Earnings money, whether it’s for escalating costs for the basics, or if you have a heavy debt load. This is another important feature of the inflationary economy, is that you carry larger debt loads. And so those two things go together. But in order to service either one of those or both of those, you need income, you need money from the paid labor market. And this really. There was a wonderful word in my dissertation process that’s in the book, and it’s the word proletarianization.

Jacob Winograd [00:41:26]:

All right.

Jeffrey D. Degner [00:41:28]:

Put another way, the world of total work, the startling phrase that comes from a German philosopher by the name of Joseph Pieper, P I E P E R. And the title of the book where he uses phrase is very interesting. The title was Leisure the Basis of Culture. It’s a profound title to think through. It is leisure time, you know, time that is not spent in the labor market earning money, where we get the arts, where we teach our children to read, where we spend time in worship and truly. Right. Leisure. If you think of it as rest, if we are to rest in the Lord and enjoy his presence, that’s a leisure activity.

Jeffrey D. Degner [00:42:14]:

We can certainly worship the Lord in work, but there is this call to, like Jesus would rise up early and spend time in fellowship with the Father. Right. Well, if you’re pressured to rise up early and make sure you get to work so you can get 60 hours in to make ends meet, that’s a much tougher challenge than it otherwise would be.

Jacob Winograd [00:42:37]:

Right. Yeah. So, I mean, it’s beyond just the family restraints. There’s a restraint that comes to just our ability to seek after the Lord, to do things with our churches. The first and second order consequences are really staggering when you stop to think about it. Then all this, there’s the debt, there’s the financial stress, the loss of purchasing power, and then all of that leading to people working harder, seeing each other less, you know, maybe not being as spiritually filled as we would, you know, want them to be. And this leads to, I think, correct me if I’m wrong, But I think still the like, number one sided reason in like studies and whatnot, like lead to divorce is like financial troubles.

Jeffrey D. Degner [00:43:27]:

Yeah.

Jacob Winograd [00:43:28]:

And it tears families apart. So, you know, this is, you know, I think another reason, like if we’re going to hold as Christians, marriage in a high degree. We talk about defending marriage. Right. That’s a, that’s a kind of a conservative buzz term, so to speak. Right. You know, defend marriage. It’s like, you know, I will take, you know, Republicans seriously that they want to defend marriage.

Jacob Winograd [00:43:51]:

When they start, you know, chanting, people want to chant. And the Fed. Right. You know, like when, like, like Ron Paul understood, you know, like I believe Ron Paul when he says, you know, he’s been married forever, he doesn’t go and party and do things like a lot of the Republicans do. But also, you know, he understands the dangers of, of, of what we’re talking about here.

Jeffrey D. Degner [00:44:12]:

Yeah, sure.

Jacob Winograd [00:44:13]:

Is there anything you want to add to that just in terms of the way that, you know, this doesn’t just, this isn’t just dollars and cents. This is literally like sometimes the difference and the tipping point between families staying together and families falling apart?

Jeffrey D. Degner [00:44:28]:

Yeah, absolutely. You know, one of the things that I touch on in the book is that the inflation culture that is created by central banks and what we’ve experienced in the 20th century and beyond here in the U.S. well, one of the features of the inflation culture is an increase in what economists call moral hazard. Now, moral hazard, the shorthand for it is that you take greater and greater risks than you otherwise would. Right. So when it comes to financial decision making, we can see, and we do see people taking greater and greater financial risks at both ends of the socioeconomic spectrum. So what does enhanced risk taking look like for folks in the lower income brackets? Well, I can tell you one thing for young men, I’m very concerned about this. When they look at kind of a bleak financial future.

Jeffrey D. Degner [00:45:26]:

A lot of our young men who’ve got gambling sorts of gambling apps on their phones, that is an increased risk taking that they wouldn’t normally take on unless they knew that they sort of had to hit a big payout in order to make their car payment or their rent payment this next month. So that’s one example of what increased moral hazard, increased risky behaviors in the financial sense can look like for poorer folks or for young men. And of course, if you’re a young man who engages in this kind of financial decision making, that does not bode well for you. If you’re meeting a young lady and she sees this is going on. That’s not a reliable behavior. That doesn’t bode well for marriage. Or if you hide it and you do get married and all of a sudden you’ve got thousands and thousands of dollars of gambling debt, this destroys marriages. So that’s a case for maybe younger or less well off folks.

Jeffrey D. Degner [00:46:27]:

But then on the flip side, if you are on a more wealthy sort of track, there are still increased risks. Right. One of the ways to get ahead in a financialized or inflationary economy is to keep leveraging your way into say a bigger and bigger house. And we saw that bubble blow up and folks in 2008 and I believe we’re on the verge of something similar right now. You look at housing markets, it is interesting that in terms of overall indebtedness, it’s actually wealthier families who carry even by percentage larger debt loads than poorer families is very interesting because they’re heavily leveraged into their homes. Their two car payments, their student loan debt, haven’t even touched on that one. But indebtedness among the upper classes is a serious issue and leads to increased financial fragility. And when those tension points come up in marriages, even among the wealthy, that can definitely be a recipe for marital disaster and divorce and really ugly outcomes there.

Jeffrey D. Degner [00:47:39]:

So yeah, this is not, this is a situation that is impacting families of every, every income bracket.

Jacob Winograd [00:47:48]:

Yeah, no, absolutely. Even just, you know, credit card debt and people taking out loans, you know, even like, even if they’re renters, right. They, they can’t leverage the equity in their home and, or anything like that. That’s a big part of this as well. It’s all and all fueled by the fact like there is just so much credit that is given to people and businesses that like now, like, I want to be careful when I say this. I’m not saying we should look down on these people and be like, you know, we shouldn’t want them to get out of their bad circumstances. You know, we as Christians should want to help them to get them back on their feet. The answer is not to throw cheap credit at them that they’re not going to be able to.

Jacob Winograd [00:48:33]:

That that is a short term fix that then just snowballs into, you know, your people who are, I mean, I mean, I’ll just say it like I at one point in my life was tens of thousands of dollars in credit card debt and got got out of it. I’m in a, in a, in a better place now. Although having to change careers in jobs in the middle of COVID you know, a lot of people had to do that again. And. And this is the kind of thing that we live. I want to touch on time preference a bit because that’s kind of the underlying sort of like, economic mindset that I think I want to get people to talk about more and think about more, because all of what we’re talking about here incentivizes people into this very high time preference mentality. Where it disincentivizes is planning for the future and savings.

Jeffrey D. Degner [00:49:29]:

Yep.

Jacob Winograd [00:49:30]:

And some of that is. Is it’s not even just an incentive. Some of it is just the, like, how are you able to save when you’re living paycheck to paycheck? Right. Yeah. Like, yeah.

Jeffrey D. Degner [00:49:40]:

Or you get a 0.5% interest rate on your local banks, your local credit union CD, but meanwhile, you’re watching your grocery bill go up 3, 4% a month.

Jacob Winograd [00:49:51]:

Right.

Jeffrey D. Degner [00:49:51]:

I mean, the math isn’t mathing at that point.

Jacob Winograd [00:49:54]:

Exactly.

Jeffrey D. Degner [00:49:54]:

And my professor, Guido Holzman, uses the phrase that is financial suicide to save under those conditions through those kinds of instruments. Right. So you’re incentivized to more risky behavior or to say, you know what, tomorrow is bleak. So we’re going to live for today and we’re going to consume everything we’ve got. And this is, this is partial.

Jacob Winograd [00:50:19]:

How do you. My dad used to say, I can’t take it with me.

Jeffrey D. Degner [00:50:22]:

Yeah, well. And this process, though, is part and parcel of the Austrian business cycle theory. When you have a central bank that suppresses interest rates below the market rate, and that market rate is based on people’s time preferences. All right, so not to get too far into the weeds here, but if you have that suppressed interest rate like we just described, 0.5 at the bank, but my groceries are going up 3, 4%. Then again, you’re incentivized to consume today. And in that way, it’s a very rational thing to do. It’s a thing that makes sense. And when we tend to consume more, we tend to save less.

Jeffrey D. Degner [00:51:04]:

And that, of course, touches on our engagement with the church and with the body of Christ and our ability to be generous in that space, let alone your own household savings. So the suppression of interest rate is corrosive not only to your family’s future, but even to philanthropy, broadly speaking, and more specifically to the church of Christ. And so this is another area of concern that Christians and pastors, I think we need to play a role here. I’ve been in a number of different churches through the years, and I kind of Grit my teeth a little bit when pastors kind of finger wag at their congregations about, you’re all so consumeristic and, you know, materialistic. And they make it only a moral issue that there are moral failings. And indeed we do need to exercise self control. I’m not denying that that is important. However, when the math isn’t mathing and you’ve got to make ends meet and you’ve got the, you know, your student, your student loan knocking at the door and your inability to pay and you can’t discharge that in bankruptcy.

Jeffrey D. Degner [00:52:18]:

I’ve even had folks raise the question, some of the pop kind of financial advisors in Christian circles, like at Dave Ramsey and people like this, but those folks will raise the question, look, if you’re a Christian and you’re in a church and you’ve got a boatload of debt, don’t give until you take care of the debt. And I’m not sure that that’s precisely that there’s any kind of biblical prescription for that. But in a very real sense, we are called to pay what we owe. And so as a family making those decisions, you know, what comes first? What comes first? Do we avoid foreclosure or do we go ahead and give? And this is a tough situation that we don’t need to be in because inflation is not a natural part of a properly functioning economy. Inflation is a policy choice, right?

Jacob Winograd [00:53:11]:

How much of this is like. Let me think about this question for a second. So how much of this is because we have been raised to view certain markers as indicators of economic health when they’re not that like we, because of the inflation culture you’re speaking of, we view spending as a sign of economic health. Right. We look at like the GDP and we look at like, you know, how, how large is that? Right. Not considering, okay, how much of that is government spending? How much of that is people spending money that they don’t have? Because again, going back to the beginning, this money isn’t grounded in anything. We’re not using equal, equal weights and measures. And so we, we have a distorted view of, of wealth and property.

Jacob Winograd [00:54:04]:

And so that leads, I think, to what we’re kind of getting at here, where it’s not that we want people to be led by money. Like that’s not what we’re saying here. We’re not saying that money is the end all, be all, but property is sort of like a inherent part of God ordering and design for creation. Getting back to that sort of creation mandate for how we operate in the world, I Mean, even, like, churches cannot do, you know, ministry. Right. You know, without some, you know, basic economic planning on their part. Right. So I think, you know, I’m always careful to try to not blend my libertarian tropes into my Christianity too much.

Jacob Winograd [00:54:57]:

But I really do think that, you know, everything is economics in a sense. Right. And even what we do as Christians in matters of faith and family and community, I think we need to sort of like, rethink, you know, the way we compartmentalize life into, like, these different spheres and start realizing that everything is economic and that, well, I have something else I want to touch on, but is there anything you want to say to that? Just in terms of the, you know, reframing this in terms of, like, how we look at economic signals and just like, how we view economics in terms of not just like the. It’s not just the stock market, it’s not just your savings account, it’s not just your IRA and retirement. It’s like everything we do, in a sense, is, you know, affected by or. Or acting out of. Of economics.

Jeffrey D. Degner [00:55:51]:

Yeah, yeah. I mean, just think about your. What do you spend your time on? Right? This is an economic choice. What we decide is to spend our time on. Is it on labor in the labor markets or is it on these leisure activities that we described earlier? That’s an economic choice. And so, boy, there’s a number of important things there. But I like to go back with our students and talk about the root word, the word economia. This is household management in the Greek sense, right? So economics is about daily household choices.

Jeffrey D. Degner [00:56:30]:

And this is one of the reasons that I have such affinity and appreciation and am a part of the Austrian school, is that we view economics as viewing or looking at or examining human choice full stop. Right? What do you spend your leisure time with? What do you spend your labor time with? How do you use your money, et cetera. And so that’s a very broad way of looking at economics. It’s not so narrowly focused on GDP or inflation numbers or how it’s even calculated. Right. So I think that that’s an important piece. And as Christians, right, we’ve been informed what we are by the Scriptures, right? We’re image bearers. We have those five offices that I described earlier in Genesis 1:27.

Jeffrey D. Degner [00:57:26]:

And our point of existence is to glorify God and to enjoy him, enjoy him forever. And so, as crass as it might sound to some people, the enjoyment of God is an economic choice. It’s about our time expenditure. It’s about what we delight ourselves in what do we seek first and our actions and the goals that we’re trying to reach using those actions and the means available to us. Includes how we worship, includes how we spend our money, includes how we give it, includes how we speak with our children or our spouse. That’s economics in the broadest sense. And so I really resonate with the prayer of the psalmist. It says, lord, teach us to order our days rightly.

Jeffrey D. Degner [00:58:22]:

Order our days rightly. There’s that decision making language, our time expenditure language right there. And economics is pervasive in that kind of language. That’s what you’re doing, is making choice with your scarce resources. Oh, Jacob, actually, I just lost your audio.

Jacob Winograd [00:58:43]:

I’m muted. I muted. That was my bad.

Jeffrey D. Degner [00:58:45]:

Oh, okay.

Jacob Winograd [00:58:46]:

All right. So let me re. Pick up where I was. So something I want to sort of like then pivot to, which I think will sort of be a way to sort of start to bring this to a close, to really drive home the full stakes of this. We’ve talked about how it affects families, how it affects churches. You also touch on in your book how the inflation culture and welfare is also influencing culture in negative ways. And some of this I think is somewhat known to people, but it’s almost like they only know the tip of the iceberg. I think it’s somewhat common knowledge that there is a perverse incentive to the welfare state and it can sort of incentivize single father household or single mother households.

Jacob Winograd [00:59:34]:

And that can lead to the degradation of communities and cultures. You see a lot of urban areas who are kind of stuck in perpetual poverty and high crime rates. But I think there’s also beyond just welfare, the role that inflation and our monetary policy plays into all this goes into that time preference sort of discussion that we brought up. Because if economically with your, your money and your life choices, you’re only. You’re oriented by the system you live in to just consume and think about today. How is that bleeding into. Because we are creatures of both body and mind and spirit. How much is that bleeding into what we decide to do with our sexual choices, how we interact with drugs and sort of like, you know, mind altering substances or even just things like alcohol and whatnot.

Jacob Winograd [01:00:41]:

How much are we looking because of the stress of everything we’re looking for escapes from reality and. Yeah, and things like that. And this is something that I think is most famously brought up by like Hans Herman Hoppe, that this idea that mentioned that, yeah, this, this is sort of like the, the Federal Reserve and Central Banking and, and this sort of also like the bailout component of all of this, which is not just towards the rich but also towards the poor, is sort of creating this culture of high time preference and the opposite of taking personal responsibility, like to sort of like we are in all these different ways not just incentivizing, we are almost subsidizing the sort of degeneracy that Christian conservatives rightfully call out.

Jeffrey D. Degner [01:01:35]:

Right.

Jacob Winograd [01:01:35]:

But I think they, and then the only response they have is to rely on state power to try to, you know, just, you know, force people to stop. It’s, it’s really just kind of like, you know, a complete misdiagnosis, not understanding, you know, all of the things that led to where we’re at today.

Jeffrey D. Degner [01:01:57]:

Well, you, you referenced Professor Hoppe and so I’m not sure if everyone’s familiar with the story on why you would bring that up, but when it comes to this, what we call a high time preference rate, I express this to students in a nutshell, saying this is a measure of your impatience or a live for today attitude. Professor Hoppe, while he was at unlv, made the point that in cultural or even sexual behaviors, one of the ultimate expressions of high time preference live for today sexual behavior are homosexual acts. And in the PC environment that was there, he was run out for making what is actually a correct observation. Because by definition, as a homosexual couple, you don’t need to think about children, you don’t need to think about the next generation. And so he makes that point and his colleague Murray Rothbard passed away in 1995. But in some of his writings he said, if you can imagine in a thought experiment that, you know, you and I knew, like for sure we got it right this time. Armageddon is tomorrow, right? What would happen to the general sorts of behaviors that we see around us?

Jacob Winograd [01:03:10]:

Right.

Jeffrey D. Degner [01:03:10]:

Well, you know, you can probably, there’s probably some movies about this where people just go absolutely crazy and degenerate sort of living, eat and drink for tomorrow we die. Right? But it’s not just, you know, that. That’s one side where, where Rothbard and Hoppe have observed that high Thai preference rates lead to this sort of, you know, degenerate or very short term thinking. On the other side of sort of economic history, you have John Maynard Keynes, Right? And he is speaking of degenerates. I mean, it is known that John Maynard Keynes was a, he was a touring pedophile. I mean that, that’s a, that is a fact. And what did Keynes say about the future he said, well, don’t worry about inflation because in the long run we’re all dead. And so you see where a person’s own degenerate lifestyle is described in Romans 1, right? They suppress the truth in unrighteousness.

Jeffrey D. Degner [01:04:07]:

In other words, it’s their personal unrighteousness that causes them to latch onto falsehood.

Jacob Winograd [01:04:14]:

Right.

Jeffrey D. Degner [01:04:14]:

That inflation doesn’t matter because we’re dead in the long run. Well, inflation does matter in the long run because your children and your grandchildren are going to have to work twice as long as, as you did to have a sort of middle class standard of living. But for folks like Keynes who revel in that degenerate lifestyle, it’s no matter to them. Right? And so as Christians, this is one of the reasons that when we look at and critique and call out, rightfully call out sinful behavior in the world, that we ought to consider the kind of economic choice environment that we’re living in. And we’re living in a world where we are incentivized by the Federal Reserve and their handlers, if you will, to live for today and to forget about tomorrow and certainly to pay no mind to eternal consequences.

Jacob Winograd [01:05:08]:

Yeah, no, I couldn’t, I don’t think I could say it much better than that. And I think that we as Christians have to, we have to be able to make a delineation between like identifying things as sinful, but then understanding that force outside that limited component where it’s ordained to be as a response to aggression is not the right tool for combating sin or for shaping culture, trying to lead culture. You know, I don’t think we’ll ever perfectly obtain that sort of like original, you know, what you called, like the cultural mandate or dominion mandate that’s laid out in Genesis. But we can, you know, we can make things better or we can make things worse. And I think we’ve done a good job here so far today in this conversation showing how the central banking system and inflationary forces at play because of it only make things worse and only at the end of the day. I think we kind of started out, you brought up the, you know, seek first the kingdom of God. The, the, the Federal Reserve is one of the biggest barriers to Christians ability to faithfully do that, I think. And so that’s why, you know, we as Austria libertarians, we say end the Fed.

Jacob Winograd [01:06:35]:

Right? You know, we don’t, we don’t party, we don’t believe we, we need this sort of thing. For some people, that’s going to be a little bit radical. That’s going to be like a, you know, like, well, what. Well, what decides the interest rates and what decides, you know, how much money we need if it’s not a central bank? Right. I mean, and isn’t this like a novel idea, something you touched on in your writings a little bit, is that this isn’t like a new thing even for Christians, that there are even, you know, Christian those in church history who called out things like we’re calling out today. So if you want to comment on that, and then we can close out.

Jeffrey D. Degner [01:07:18]:

There’S a couple things there. But I think that this alludes to the prophetic voice, right? That we use persuasion and power of the gospel, power of the word. It doesn’t return void. It will be used in the way that God wants it to be used to transform hearts or in some cases, like the pharaoh, to sear his conscience where he hardens his heart. And so that message needs to. It needs to ring loud and clear. And I alluded to Isaiah chapter one and Ezekiel 45 at the opening here, but Isaiah chapter one talks very specifically about how the kings of Judah were debasing the currency. And in chapter one, verse 21 and beyond, you see the statement that your silver has been filled with dross.

Jeffrey D. Degner [01:08:10]:

That means an inferior metal. So these kings, Ahab and Omri and others were actively debasing the currency. That’s that inflation process, devaluing the money. And there’s an immediate response in the market, and that is for other people to swindle their neighbors. The second half of that verse, your silver is filled with dross, and now your wine is diluted with water. People begin engaging in this dishonesty under the inflationary condition. And this is the opening indictment that Isaiah brings against Judah. This is the reason for cultural decay and for really one of the key root causes of their exile.

Jeffrey D. Degner [01:09:00]:

Because the rest of chapter one details all of the injustices that flow from that injustice of debased currency. So we need to deploy the prophetic voice. I love thinking about Nathan and his confrontation with David. He uses an illustration. And after David is enraged by the injustice that was described, he says, you’re the one, right? And so when we think about, you know, rising economic inequality, injustices towards the poor, destroyed family life, we need to point at the Federal Reserve and say, you are that organization. You are that cause. And I know for some folks that’s going to sound very radical. But my response to that is, at what point in history, in the history of the church, have Christians not been marginalized for their radical views.

Jeffrey D. Degner [01:10:00]:

Radical views like Caesar is not God. Jesus, who was crucified and raised from the dead, he is Lord. That’s a radical view that’ll get you killed. We know in the abolition of slavery, I think of William Wilberforce. Wilberforce was thought of as a nut job because, after all, slavery is just a part of the natural world, right? But he takes moves, uses the prophetic voice very wisely and shrewdly uses the laws and persuasive tools at his disposal to abolish it in Britain. So I think that we’re, as Christians, called to identify these injustices and by God’s mercy, be a part of sweeping them away. Because at the close of Isaiah 1 and then going to Ezekiel 45, God tells us he will sweep that sort of system away. He will do it.

Jeffrey D. Degner [01:10:54]:

And once justice is restored, once the exiles return back. Ezekiel 45, one of the first commands he gives to the princes is, this is the weight of metal that is going to be in a shekel and don’t deviate from it. That is the first call to justice for a ruler, if you will. It’s to set the money right and set it at a fixed, anchored standard, and then you can move forward with a just approach to civil governance and so forth. So my confidence is in the Lord. Not that we’re going to come up with some kind of clever strategy, but we should still strategize, but we should still speak truth to the powers that are creating this injustice. But the Lord ultimately will be the one to do the work. We’re just called to be faithful in it.

Jeffrey D. Degner [01:11:45]:

And Ezekiel’s call, Ezekiel, chapter three is one of my favorite passages. It really emboldens me and hopefully other believers. He says, look, the Lord tells him, this is the message that you need to deliver. They aren’t going to listen, but if you don’t speak up, the blood of the nation will be on your hands, Ezekiel. But if you do speak up and do so with boldness, then those who refuse to heed God’s call, they will be the ones to bear responsibility for their disobedience. And so I think that’s sort of where we’re at in this area. And so I just, by God’s grace, want to be a part of calling that out with a prophetic voice. And I appreciate you having me on and engaging in that.

Jeffrey D. Degner [01:12:28]:

Good work together, brother.

Jacob Winograd [01:12:30]:

It’s much appreciated. Amen. Well, all that was so well said. And just to piggyback on that, it’s. It’s not only so that, you know, we know that the blood’s not on our hand, it’s so that we make sure that the integrity that the character that the witness of Christ and his gospel that we are supposed to be bringing to the world as ambassadors for his kingdom is not tarnished. If we’re not out there, not only is it bad if we’re not out there speaking against injustice with that prophetic voice, but if we are at any point, you know, the champions of the warfare state, the welfare state, the inflationary, you know, sort of like bombardment on families and culture that we’ve laid out, here, we are, at the very least, you know, at high risk of, you know, undermining that gospel message and of taking the Lord’s name in vain. And, you know, for me, and I don’t say that like a legalistic sense, but just in terms of, like, if you want to be. If you want to claim Christ as your Lord and Savior, you know, like, understand what those words mean, that does call you.

Jacob Winograd [01:13:43]:

And like, I know there’s parts in the Bible that say to kind of like, you know, live quiet lives, but I think. I think that’s sort of like, you know, wisdom to be, like. We say very radical things, so you’re gonna get. You’re gonna get by in life better if you live a quiet life. So that when you say your radical things, people don’t just instantly eyes up to kill you where you stand, Right. It’s like. It’s like, oh, he wants to do what? He’s like, yeah, but he’s like, such a nice guy and just has a. You know what I mean? So it’s like.

Jacob Winograd [01:14:10]:

Like, we. We need to get. There’s something we’ve lost as Christians in the west because I think we. We kind of got lulled into a sort of comfort with sort of the sort of like a hegemony that we had in the west for so long that we’ve forgotten what it’s like to be countercultural and to. With kindness. Yeah, yeah, yeah, exactly. Speak the truth in love.

Jeffrey D. Degner [01:14:33]:

Yeah. And. And this was one of the great takeaways among Austrians. They’ll. They’ll know who my professor is. And I say my professor because that’s the relationship in a European context. So I was asked by a good friend after I was winding up my Ph.D. what was the great.

Jeffrey D. Degner [01:14:51]:

You know, Guido Holzmann is very respected in Austrian circles, and what was it like to work with him? What was your biggest takeaway? And I think he was looking for some deep insight into economics. And I said, you know what? It was essentially how to be a bold gentleman. That was it. Now, as a Christian, we would say, like to speak the truth in love, but that is, I think, the great life lesson that I took from being under his academic and professional and even spiritual guidance during that process. But, but we can do that. So it’s not, you know, to be a Christian radical is not to be some bomb throwing, wild haired, you know, maniac. It’s to sometimes speak the truth.

Jacob Winograd [01:15:36]:

Yeah, but sometimes you flip a couple tables. Indeed.

Jeffrey D. Degner [01:15:41]:

Yeah, those, those money changers. Maybe that’s a talk for another time.

Jacob Winograd [01:15:45]:

Oh, it definitely would be. Jeff. This has been so much fun. I feel like we could go for another hour, but respect for both of our times and that I need to go wisely, spend my time in a very economic fashion and go see my wife tonight.

Jeffrey D. Degner [01:16:02]:

I’m valued in hanging out with me, so I concur.

Jacob Winograd [01:16:05]:

Appreciate you.

Jeffrey D. Degner [01:16:06]:

Thanks.

Jacob Winograd [01:16:06]:

But thanks Jeff. Thanks everybody for listening. And as I always conclude by saying, live at peace. Live for Christ. Take care.

Biblical Anarchy Podcast Announcer [01:16:14]:

The Biblical Anarchy Podcast is a part of the Christians for Liberty Network, a project of the Libertarian Christian Institute. If you love this podcast, it helps us reach more with a message of freedom when you rate and review us on your favorite podcast apps and share with others. If you want to support the production of the Biblical Anarchy Podcast, please consider donating to the Libertarian Christian Institute@biblicalanarchypodcast.com where you can also sign up up to receive special announcements and resources related to Biblical Anarchy. Thanks for tuning in.

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

Federal Reserve

LCI uses automated transcripts from various sources. If you see a significant error, please let us know.

Sign up and receive updates any day we publish a new article or podcast episode!