Ah taxation, how we despise thee. You make some richer, but most poorer. You daily remind us that we live not in a free society, but under shackles. Let us count the ways you oppress us:

#1: Lost Productivity

Ever wondered how much time and money are lost through federal tax returns? It actually is rather astounding even by conservative estimates. Let’s run the numbers in back-of-the-envelope style calculation.

Consider that I, a moderate income citizen, have spent nearly eight hours thus far on my taxes. This includes going to the store to buy Turbotax, organizing all my papers, making calculations, typing, figuring out where things go – and I’m not even done yet. I anticipate I have at least four hours of work left, but for the sake of our conservative calculation we’ll assume that most people spend about eight hours on their taxes per year.

According to the latest census data on Wikipedia, roughly 300 million people live in the USA. I would estimate that about half of them work and do tax returns, which is roughly 150 million. (It appears that the number may be closer to 168 million according to Wikipedia.)

Consider, then, that around 150 million work or leisure days have been lost due to tax preparation. It’s hard to estimate how much lost productivity there is embedded in this number, but suppose we can put a value on that time… A little digging through Google seems to indicate that the average wage per hour in the USA can be very conservatively estimated at $15 per hour. This translates to $120 per day, that’s roughly $18 billion in lost productivity.

That’s a pretty large number, but in reality I’m just scratching the surface. I can’t even begin to imagine how the number increases when you add in purchases of tax software, purchases of tax services, and the expenditures of the IRS in processing and auditing. I think it’s probably safe to say that we are talking about a 10’s-of-billions-of-dollars industry of nothing but waste. Of course, that’s the function of the “state” in a nutshell – plus injustice, rights abuse, death, and destruction of private property.

Strangely enough, doing tax returns is, in another sense, a rescuing of productivity as well. The fact that this much effort is being put into getting as much of our hard-earned money back from the Federal Government is indicative that there is more to be gained in doing the tax return than not. How unfortunate that this must happen in the first place…

Thanks to Clear_Mark for inspiring this installment of 10 Things I Hate About Taxes.

#2: Newspeak

In George Orwell’s incredible work Nineteen Eighty-Four, Ingsoc has brainwashed society into accepting their government through the mutilation of language, such as in the government’s motto: “Freedom is slavery, ignorance is strength, war is peace.” Orwell calls it Newspeak. Comic book author Alan Moore gave this linguistic phenomena in V for Vendetta the particularly eerie religious overtone of clerical fascism embedded in England’s propaganda: “Strength through Purity, Purity through Faith.” (Note this is different from the movie version which replaces purity with unity.)

Governments manipulate language for their own purposes constantly. It allows them to circumvent truth in the public square (at least to the unobservant eye and ear). Whenever you hear a politician say, “Mistakes were made…” you can be 100% certain that they are dodging responsibility.

This is most perfectly exemplified in government’s first order of business: taxation. In fact, the very notion of taxes masks the truth of the matter, that taxation equals theft. But the government goes even farther in the corruption of nomenclature…

They claim their confiscation is a “service” and that we victims are their “customers.” As if I agreed and wished this upon myself. As if I am engaging in peaceful trade with them. Rubbish.

They call the loot they plunder “contributions” and “obligations.” A contribution is willingly given, an obligation is willingly traded. But if taxation is coercive then these are nothing short of non sequiturs.

Can you imagine the self-delusion the IRS and Congress must inflict upon themselves to justify their actions? “Oh, we have to convince them that this is what they want [read: we’re too dumb to see it their way] so we must recast this into a positive light…” Perhaps bureaucrats and politicians are well-intentioned, but the well-intentioned thief is still a thief.

These are just four examples of taxation Newspeak. Can you name some more?

Amazingly, upon reflection you cannot help but have some semblance of respect for burglars and robbers. As my friend Bryan says, “At least they’re not deceitful or patronizing about what it is that they’re doing.”

The next time you encounter those who believe the lie, call evil by it’s name.

Thanks to Bryan, head admin of the Christian Libertarian Yahoo Group, for inspiring this installment. He is a dear friend and I wish him every blessing.

#3: The Truth About Government Spending

Politicians, especially Republicans, love to talk about “cutting taxes,” and in some cases they actually do cut some taxes and ease the burden of all. Unfortunately, this masks the dirty, grimy truth that no statist wants to hear: it isn’t how you are taxed that really matters, but how the government spends.

It is really quite simple to understand. The government cannot create wealth on its own. If it could, it would be a business and trade peacefully. Instead, all government “products” are constructed through the resources of others – taxes. And those spent scarce resources constitute that which is used up, that which could have been allocated for wealth creation under the free market.

If the government “cuts” taxes and yet continues deficit spending, are not resources still being consumed? Of course they are. Whether or not you agree with the Laffer curve theory, deficit spending is obviously not sustainable. Whatever is spent must be repaid, and it will be paid for by future confiscation of scarce resources. So, a reduced tax now without spending reductions most certainly means greater taxes later, and likely with interest upon the national debt. The presumed authority of the government to spend to no end is anathema of liberty.

Thus, we see the reality of taxation clearly. Every cent that the government spends is the tax, not merely what is collected. Every cent spent is an income tax. Cutting collected taxes without cutting spending is merely tax deferment, nothing more.

Now, of course I am not saying the unthinkable, that we need to RAISE taxes in order to reach sustainability again. By no means! Rather, we should remember that your tax burden is not just what is withheld every month…

I say it’s time to declare a War on Spending. Where do you want to start?

#4: Privacy and Personal Income

The Fourth Amendment (IV) of the Bill of Rights says:

The right of the people to be secure in their persons, houses, papers, and effects, against unreasonable searches and seizures, shall not be violated, and no warrants shall issue, but upon probable cause, supported by Oath or affirmation, and particularly describing the place to be searched, and the persons or things to be seized.

I read this amendment as saying that the only time “reasonable search” of my possessions – which includes information about me as well – can occur is when a warrant has been issued with probable cause. All other searches I am free to reject, for any reason whatsoever.

So how can the government claim the right to require me by force to give up information about my income?

If you don’t believe that, well then… the Ninth Amendment (IX) says:

The enumeration in the Constitution, of certain rights, shall not be construed to deny or disparage others retained by the people.

The language here is a bit tricky, but stick with me… The word “enumeration” according to Dictionary.com means, “To count off or name one by one; [to] list.” So we should read this as, “Yo, America, you know those rights specifically listed? That’s not all, everything else is yours too.” In other words, your rights are assumed, not given by the government.

Let’s ask again, what right does the government have to my income, or even the information about my income? Constitutionally, the government does not have the right to force information about my income from me.

Of course, this didn’t stop Congress from trying on various occasions, and it didn’t stop them from passing the Sixteenth Amendment (XVI):

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

Notice the wording at the end, “without regard to… enumeration.” So essentially, Congress at the time understood that the Constitution forbid them from doing this very thing. It was embedded in the Fourth and Ninth Amendments that this this right belongs to us, and yet no longer.

What happens when the Constitution is now inconsistent with itself? Do we really have a right to privacy, or not?

Or am I wrong to interpret the Constitution in this way? No wonder the repeal of the Sixteenth Amendment is so high on Ron Paul’s to-do list. If Congress has the power to repeal rights with the stroke of a pen, we are steps away from tyranny. Perhaps we are already there…

Thanks to Greg at The Holy Cause for inspiring part of this article.

#5: Your Tax Dollars at Work

Think about all the crazy things you know your tax money pays for…

- Unconstitutional wars

- The Welfare System

- Subsidizing unemployment

- Foreign aid – Seriously, do we just hate the human race or what?

- Regulation upon regulation

- Bailouts

- Corporate welfare

- Stupid retail development projects

- Paying this guy’s salary

- The War on Drugs

- The War on Poverty

- The War on Terror

- Inauguration expenses – Why should I pay for people to go worship a state leader?

- Stopping “climate change”

- Oil subsidies

- Public transportation programs that no one uses

- Cow fart research – well, actually they research enteric fermentation…

- Morally dubious research, such as stem-cells, abortion, and America’s very real WMD programs

- Disaster relief that doesn’t work (cf. FEMA)

- Social Security

- The Department of Education (down with nationalized public schools!)

- The REAL ID Act and its execution

- Congressmen’s salaries – I wonder how interested they would be in passing laws if they didn’t get paid for it…

- Socialized health care (including Medicare)

- Vampire Cops

Sometimes I feel that paying my taxes.. is like throwing money down a giant hole…

(Pardon the mild profanity at the beginning of the video.)

We’re just getting started here, that list can go on and on… Want to add something? Comment below and I’ll put it up! Links are good too, just remember that if you put more than 2 than the comment is automatically held for moderation.

#6: Withholding Taxes

If we were required to pay all our taxes for the year on April 15th, and on no other day did we ever have pay any taxes (sales, property taxes, whatever), then most Americans would be absolutely astounded with the amount of money the government demands from them. In all likelihood, most people do not consistently carry a balance that high in their bank account.

The withholding tax allows the government to make their insane demands more palatable to us. A penny here, a penny there – these won’t add up to much in the end, right? Withholdings from every paycheck is like silent theft, gone unnoticed. If you came home one day to find your piano had suddenly disappeared, you wouldn’t be pleased. Instead, your fridge is being raided – but we’re not paying enough attention to recognize that something’s missing.

My younger sister got her first job a few years back in a clothing retail store. Since the work was part-time, her first paycheck wasn’t very remarkable, only a hundred bucks or so. She saw that the government had taken about $12 from her and she just about flipped out. “How dare they just take this money from me, they didn’t work two hours for that money!” Bless her heart, she got it. I wish I had been that smart at her age.

Here’s something even more bizarre: one of the primary culprits responsible for instituting the withholding tax is none other than the “free market economist” Milton Friedman. Murray Rothbard recounts the story in his 1971 article Milton Friedman Unraveled.

One of Friedman’s most disastrous deeds was the important role he proudly played, during World War II in the Treasury Department, in foisting upon the suffering American public the system of the withholding tax. Before World War II, when income tax rates were far lower than now, there was no withholding system; everyone paid his annual bill in one lump sum, on March 15. It is obvious that under this system, the Internal Revenue Service could never hope to extract the entire annual sum, at current confiscatory rates, from the mass of the working population. The whole ghastly system would have happily broken down long before this. Only the Friedmanite withholding tax has permitted the government to use every employer as an unpaid tax collector, extracting the tax quietly and silently from each paycheck. In many ways, we have Milton Friedman to thank for the present monster Leviathan State in America.

What’s worse, if you try to avoid paying withholdings you’ll get fined. So much for avoidance from the outset.

For further reading: The Curse of the Withholding Tax – Laurence Vance. Read the first few lines:

Did you have to write out a check to the IRS for $5,581 this past April 15? If you had to do such a thing next year, would you think of it as your civic duty or would you consider it a crime that only the government could get away with?

That’s the truth behind the withholding tax. Confiscation in silence…

#7: Caesar’s Benevolence

Many Christians believe that paying taxes is fulfilling the Biblical command to show compassion to the poor. We just need to “render to Caesar” and Caesar will do the right thing. Is this a valid conclusion?

Suppose you are walking down the street, and somebody holds you up for your wallet. But, instead of running off with it, he then distributes it to some poor people who have been following along with him. “There you go,” he says to you, as he hands back your wallet, “You’ve done your charity this week. I’ve kept some for my ‘fee,’ no run along. I’ll be back next week to do this again.”

Does that sound like benevolence to you? No? Well guess what, that’s exactly what the government is doing. A thief does not become justified if he gives what he stole to the homeless man as he runs off. He’s still a thief!

Actually, what the government does is worse…

Government benevolence is notoriously inefficient. Statistics show that for every dollar the government uses in a “benevolent way,” only 25 cents actually is used to “help” those in need (stats from Mary Ruwart’s Healing Our World). Back to the anecdote above, that “fee” of his is 75% of the initial amount. Contrast this to private charity, where on average 75 cents out of every dollar gets to those in need. Private charity is three times more effective at using resources than government!

Many people argue that if the government wasn’t “doing charity,” then there wouldn’t be enough private charity to meet the needs of people. On the contrary, people primarily give out of their prosperity (although we Christians are called to give regardless because we realize how prosperous we really are). In fact, in the so-called “Decade of Greed” in the 1980s, charitable giving was higher than ever before! (See Bob Murphy’s Politically Incorrect Guide to Capitalism). Consequently, we can expect that eliminating government “charity” will undoubtedly help more people in the long run than by retaining these inefficient and immoral programs!

Moreover, government charity, particularly welfarism, breeds idleness and delinquency, vices which Christians should avoid like the plague. 2 Thessalonians 3 says: “If a man will not work, he shall not eat. We hear that some among you are idle. They are not busy; they are busybodies. Such people we command and urge in the Lord Jesus Christ to settle down and earn the bread they eat.”

Private charity works. Unlike the government, which uses charity to build a class of people dependent on them and thereby win their votes again and again, private charities are interested in truly helping those in their time of need. They want to build people up, not make them dependent. Their service is derived from love of neighbor, not love of power.

The government is NOT a benevolent institution. Leave that to the church and other private organizations.

Thanks to Chris Bevis for inspiring this installment. Make sure to read his guest post on LCC about Rendering to Caesar.

#8: Living in Fear

To say that the tax code is complicated would be the understatement of the century. It is, in fact, far beyond complicated, so much so that no one in this world could possibly understand it. Depending on who you ask, the tax code is somewhere around 15,000 pages long. Regardless of the actual number, it is beyond the capacity of any normal human to understand.

This presents a serious problem to the taxpayer: how can he or she know that all the laws have been followed? More likely than not, something has been missed, or some error has been made. In effect, the complexity condemns us all immediately as lawbreakers. All it takes is enough will from the powers-that-be, and incarceration could be yours!

Thus, we live in constant fear, wondering whether we have made a mistake, and then wondering whether that mistake will get caught.

The complexity of the tax code is the impetus for many reform groups to promote their particular plan to “make it simpler.” And so we have the Fair Tax Plan, and the Flat Tax Plan, and others as well. However, even these ideas are sorely misguided as Laurence Vance has so eloquently made clear. Why? Because, just as I said in a previous article in this series, they don’t attack the root of the problem. We can simplify all we want, but without reducing spending the tax burden of citizens is not truly lessened. What is not paid initially will be paid later, and that with interest.

Complexity is a double-edged sword. While it does make it difficult for us to know where we went wrong, it also makes it difficult for the government to know where we went wrong too. However, we aren’t the ones pointing the guns here, so naturally we are at a distinct disadvantage.

I guess I’ll just trust in Turbotax to do the dirty work for me, and hope for the best.

“It will be of little avail to the people, that the laws are made by men of their own choice, if the laws be so voluminous that they cannot be read, or so incoherent that they cannot be understood; if they be repealed or revised before they are promulgated, or undergo such incessant changes that no man, who knows what the law is to-day, can guess what it will be to-morrow. Law is defined to be a rule of action; but how can that be a rule, which is little known, and less fixed?”

James Madison, Founding Father of the Constitution

Thanks to Vijay and Jean Paul for inspiring this installment.

#9: Taxation is Theft

I have already said and illustrated this numerous times in previous articles, but I will say it once again: Taxation is theft, period. To continue this theme, I’d like to show what a few of my favorite laissez-faire economists had to say about the evils of taxation. I have two reasons for doing this. I want readers to understand that it isn’t just me saying these things – there are many people throughout history who understand taxation in this way. Second, these economists explain these ideas much better than I can! Well, at least sometimes they can… :)

1) Jean-Baptiste Say, the formulator of Say’s Law, in A Treatise on Political Economy:

It is a glaring absurdity to pretend, that taxation contributes to national wealth, by engrossing part of the national produce, and enriches the nation by consuming part of its wealth…

Taxation is the transfer of a portion of the national products from the hands of individuals to those of the government, for the purpose of meeting public consumption or expenditure. Whatever be the denomination it bears, whether tax, contribution, duty, excise, custom, aid, subsidy, grant, or free gift, it is virtually a burden imposed upon individuals, either in a separate or corporate character, by the ruling power for the time being, for the purpose of supplying the consumption it may think proper to make at their expense; in short, an impost, in the literal sense.

2) Murray Rothbard, in The Ethics of Liberty (free HTML):

For there is one crucially important power inherent in the nature of the State apparatus. All other persons and groups in society (except for acknowledged and sporadic criminals such as thieves and bank robbers) obtain their income voluntarily: either by selling goods and services to the consuming public, or by voluntary gift (e.g., membership in a club or association, bequest, or inheritance). Only the State obtains its revenue by coercion, by threatening dire penalties should the income not be forthcoming. That coercion is known as “taxation,” although in less regularized epochs it was often known as “tribute.” Taxation is theft, purely and simply even though it is theft on a grand and colossal scale which no acknowledged criminals could hope to match. It is a compulsory seizure of the property of the State’s inhabitants, or subjects.

It would be an instructive exercise for the skeptical reader to try to frame a definition of taxation which does not also include theft. Like the robber, the State demands money at the equivalent of gunpoint; if the taxpayer refuses to pay his assets are seized by force, and if he should resist such depredation, he will be arrested or shot if he should continue to resist. It is true that State apologists maintain that taxation is “really” voluntary; one simple but instructive refutation of this claim is to ponder what would happen if the government were to abolish taxation, and to confine itself to simple requests for voluntary contributions. Does anyone really believe that anything comparable to the current vast revenues of the State would continue to pour into its coffers? It is likely that even those theorists who claim that punishment never deters action would balk at such a claim. The great economist Joseph Schumpeter was correct when he acidly wrote that “the theory which construes taxes on the analogy of club dues or of the purchase of the services of, say, a doctor only proves how far removed this part of the social sciences is from scientific habits of mind.”

3) Hans-Hermann Hoppe, in Economics and Ethics of Private Property (free PDF):

That taxation — foremost and above all — is and must be understood as a means for the destruction of property and wealth-formation follows from a simple logical analysis of the meaning of taxation.

Taxation is a coercive, non-contractual transfer of definite physical assets (nowadays mostly, but not exclusively money), and the value embodied in them, from a person or group of persons who first held these assets and who could have derived an income from further holding them, to another, who now possesses them and now derives an income from so doing…

Thus, by coercively transferring valuable, not yet consumed assets from their producers (in the wider sense of the term including appropriators and contractors) to people who have not produced them, taxation reduces producers’ present income and their presently possible level of consumption. Moreover, it reduces the present incentive for future production of valuable assets and thereby also lowers future income and the future level of available consumption.

Taxation is not just a punishment of consumption without any effect on productive efforts; it is also an assault on production as the only means of providing for and possibly increasing future income and consumption expenditure. By lowering the present value associated with future-directed, value-productive efforts, taxation raises the effective rate of time preference, i.e., the rate of originary interest and, accordingly, leads to a shortening of the period of production and provision and so exerts an inexorable influence of pushing mankind into the direction of an existence of living from hand to mouth. Just increase taxation enough, and you will have mankind reduced to the level of barbaric animal beasts.

4) Frank Chodorov, in Out of Step: The Autobiography of an Individualist:

If we assume that the individual has an indisputable right to life, we must concede that he has a similar right to the enjoyment of the products of his labor. This we call a property right. The absolute right to property follows from the original right to life because one without the other is meaningless; the means to life must be identified with life itself. If the State has a prior right to the products of one’s labor, his right to existence is qualified. Aside from the fact that no such prior right can be established, except by declaring the State the author of all rights, our inclination (as shown in the effort to avoid paying taxes) is to reject this concept of priority. Our instinct is against it. We object to the taking of our property by organized society just as we do when a single unit of society commits the act. In the latter case we unhesitatingly call the act robbery, a malum in se. It is not the law which in the first instance defines robbery, it is an ethical principle, and this the law may violate but not supersede. If by the necessity of living we acquiesce to the force of law, if by long custom we lose sight of the immorality, has the principle been obliterated? Robbery is robbery, and no amount of words can make it anything else.

#10: Lost Prosperity

I think I’ve saved the best for last… I was linked by LewRockwell.com yesterday (thanks to Gil Guillory), I’m wondering if I should submit this as an article for tomorrow… Read it and let me know in the comments…

In the first installment of this series, I talked about how much effort is wasted just doing taxes. Compliance with the law results in a massive loss in productivity that could have been used elsewhere. In this article, I want to emphasize how much wealth is destroyed due to taxes, and how much better off we would be if we didn’t have them at all. This is the lost prosperity that we have missed.

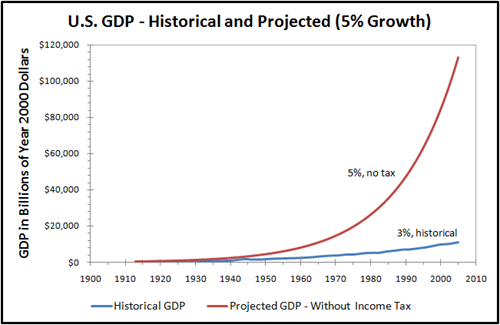

Let’s crunch some numbers. The average U.S. economic growth in GDP from 1913 to 2005 has been roughly 3% year to year. The next figure displays this in terms of Year 2000 Dollars (this allows us to take inflation into account). Recall that 1913 is the year the Sixteenth Amendment was ratified, which instituted the income tax.

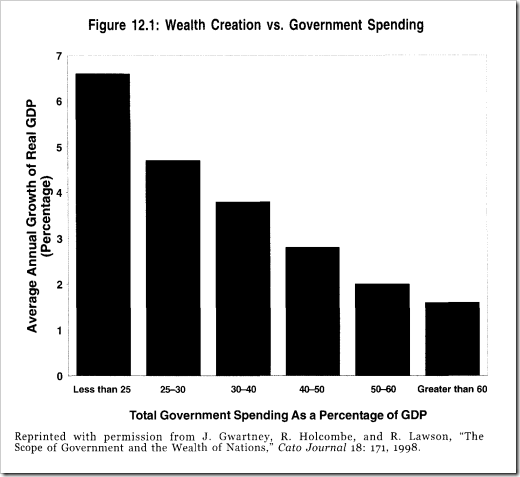

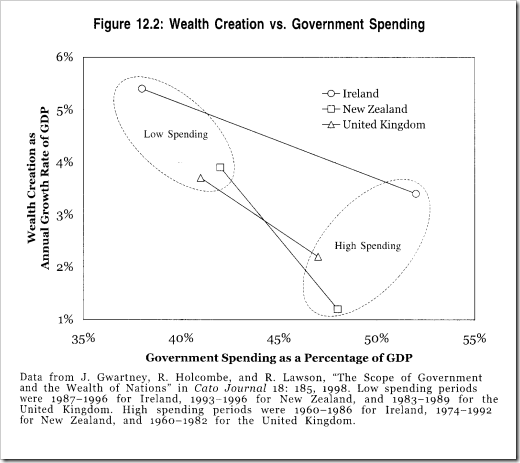

Upon inspection, one might say that this actually looks pretty good, 3% per year isn’t too shabby. However, substantial data that indicates that countries whose governments spend a greater percentage of wealth annually also experience diminished growth. I have scanned two graphs from Mary Ruwart’s Healing Our World (chapter 12) to help illustrate this. (Both are originally from Gwartney, Holcombe, and Lawson’s article entitled “The Scope of Government and the Wealth of Nations.”)

Note the trend in this first graph: the less a government spends its people’s wealth, the greater growth that nation will experience. This is correlated from hundreds of data points from various countries over time.

What is striking about this data is that as government spends ever less money, the rate of growth expands exponentially rather than linearly. In other words, a 10% reduction in government spending makes an even greater difference when moving from 25 to 15% total government spending (nearly 2% increase) than moving from 60% to 50% (about 0.25% increase).

So, does this relationship hold in specific cases? In fact, it does. This next graph shows how Ireland, New Zealand, and the United Kingdom realized greater growth when they reduced government spending (data spans the years 1960 to 1996, see the caption).

Each of these countries had governments that spent greater than 45% of their annual GDP. Thus, each country experienced low economic growth, between 1 and 4%. These are the only three developed countries that made significant reductions in government spending between 1960 and 1996. One can clearly see that when each country reduced spending, their economic growth shot up significantly. In the case of New Zealand, their growth rate expanded three times over! Less aggression expands wealth.

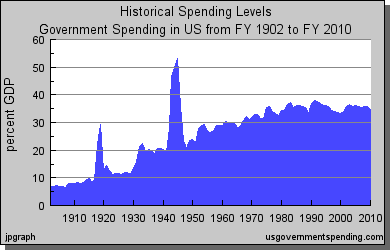

Think back to what you have learned in personal finance. Remember the concept of compound interest, that savings early on contributes to wealth expansion later? What is lost due to taxation is compounded over time. And when we consider what the United States government spends, the obvious conclusion is that we have missed an extraordinary opportunity. Over the last 100 years, the United States Federal Government has dramatically increased its consumption of annual GDP. You can readily see this in the next graph. Around 1915, the Feds spent only around 10%, and aside from the two gargantuan spikes (the World Wars), the general trend has been a steady increase to 35-40% of annual GDP. No wonder the economy is only growing at 3% in supposedly the most free nation on earth!

Now we are in the position to calculate the prosperity we have lost due to the income tax. It is actually a very simple calculation to make, if you make some simplifying assumptions.

In this case, I will assume no variation year to year in growth, and that the growth rate is 5% – only 2% above the current average rate. This is actually a conservative estimate when you think about it, because we would likely see upwards of 4-5% increase in annual growth if the income tax were eliminated as per the previously cited data. But for now, let’s call 5% the lower bound. Here’s what you get:

The difference between 3% and 5% growth is nothing short of startling. The conservative estimate is that we would likely be 8 to 10 times better off without the income tax, and that number would go up even further if the growth rate is greater. Can you imagine what could be done with this kind of prosperity? We are often amazed at what we can do and produce with modern science and technology and with the connectivity of the internet. But the difference we can anticipate with this much growth would likely dwarf what we see now. Most likely, by eliminating the aggression of taxation we would increase wealth creation somewhere between 3 and 18 times!

We have to realize that trade, the social mechanism of increasing our economic well-being, is a win-win proposition. By definition, when you and I agree to trade the fruits of our labor, we are implicitly agreeing that we are both better off by making the transaction. Conversely, government force is a lose-lose proposition. No one but the thief is made better off when coercion is exacted, and laws of nature do not change when the collector wears an IRS uniform and the spender is a government bureaucrat.

Those who argue that it is only through government that we will cure disease, help people out of poverty, and make this world a better place have not seen the data. Prosperity is what cleans up cities, gets people into jobs, and heals illness, and the government will always fail when it tries to intervene. Why? Because government only works by aggressing against its subjects, which unequivocally makes the subjects worse off.

How amazing that the world works in this way! We do not have to choose whether we will have either aggression and prosperity, or peace and poverty. Rather, peace and prosperity go hand in hand. Thank God, the created order is a win-win world.

For now, however, we have little choice in the matter of taxes. We do the best we can to avoid as many taxes as possible and live in peace, because otherwise the strong arm of the State is waiting. Let us keep pushing back the State through persuading our fellow man of the evils of the State, trading peacefully, and working for positive change in our communities.

And the fight goes on…

Epilogue

I hope you attended or supported your local Tea Party today – Tax Day 2009. Honestly, I wasn’t able to go myself because I had a theology class this afternoon. But no matter, there will be another day to protest.

I saw a very scary article today, and it should confirm everything I’ve been saying in these articles.

Regardless of what politicians tell you, any additional accumulations of debt are, absent dramatic reductions in the size and role of government, basically deferred tax increases. Remember the old saw? “You can pay me now or you can pay me later, with interest.”

Really? You mean, spending matters?

The government has over $56 trillion of outstanding, unfunded liabilities – financial commitments that you and I will pay. If this number seems hard to comprehend, then picture that this is $184,000 for every man, woman, and child in the United States. For the average American that makes only about 50k per year, he will work nearly four years of his or her life just to pay this stupid debt off. You probably need to look up this fictitious (and hilarious) accounting firm to help you out.

I shudder imagining what the American Revolutionaries would think of this. Can you imagine our forefathers standing for this? Can you imagine them staying silent as the Federal Reserve and the Federal Government destroy our livelihood and liberties?

I beg you, say something to someone, today. Stay silent no more.

This series was featured on the LewRockwell.com Blog on April 13th, 2009.

), //libertarianchristians.com/wp-content/plugins/smartquizbuilder/includes/images/template6-latest.jpeg))

), https://libertarianchristians.com/wp-content/plugins/smartquizbuilder/includes/images/template6-latest.jpeg))

;?>/smartquizbuilder/includes/images/sqb-registration-img.jpg)